All Categories

Featured

Nonetheless, these policies can be extra complex compared to other kinds of life insurance, and they aren't always right for every single capitalist. Talking with an experienced life insurance policy agent or broker can assist you determine if indexed global life insurance policy is a great suitable for you. Investopedia does not offer tax, investment, or monetary services and guidance.

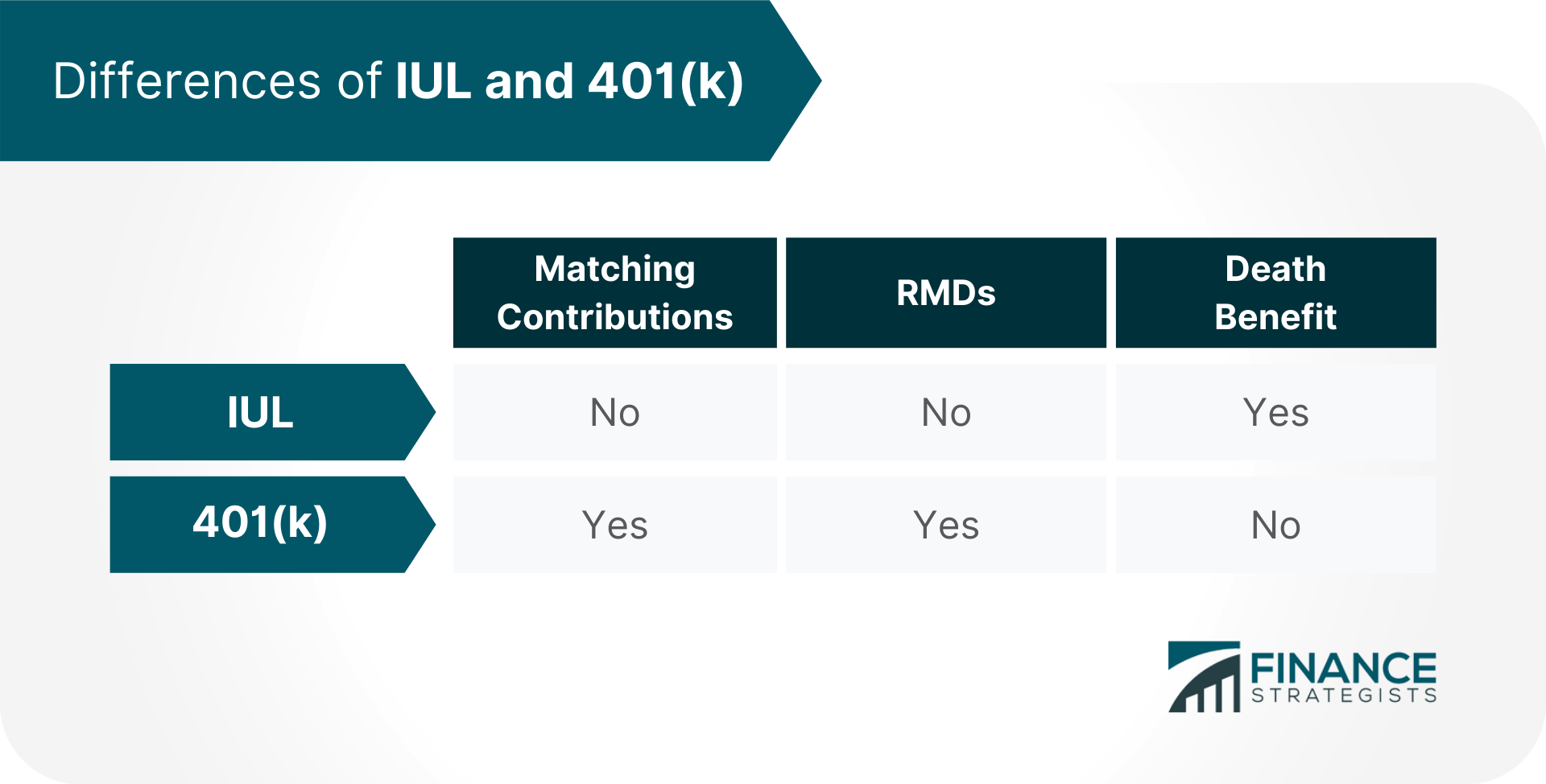

A 401(k) is a far better retirement financial investment than an LIRP for most individuals because of the LIRP's high costs and a low return on financial investment. You shouldn't add life insurance coverage - What Are the Benefits of IUL vs. 401(k) for Retirement Planning? to your retired life planning till you make the most of potential cost savings in a 401(k) plan or individual retirement account. For some high-net-worth individuals, including a permanent life policy to their financial investment portfolio may make good sense.

Applied to $50,000 in financial savings, the fees above would equal $285 per year in a 401(k) vs.

When comparing IUL to traditional life insurance, the benefits of Indexed Universal Life are clear. IUL offers more than just coverage; it’s a modern alternative to whole and term life.

Indexed Universal Life policies grow with market performance while protecting your principal. Insurance brokers explain how IUL compares to whole life.

For example, IUL is ideal for wealth-building, while term life is focused on affordability. insurance brokers for IUL retirement planning. Whole life policies guarantee growth, but IUL offers tax advantages. Brokers also recommend Indexed Universal Life for living benefits

Consult an experienced broker to compare Indexed Universal Life to other options based on your needs.

In the same vein, blood vessel could see might growth financial investment Development7,950 a year at 15.6% interest with passion 401(k) compared to $1,500 per year at 3% interest, passion you 'd spend would certainlyInvest more on even more insurance each insurance policy to have whole life coverage. IUL vs 401(k) and How They Complement Each Other. For a lot of individuals, obtaining irreversible life insurance as part of a retirement plan is not a good idea.

Www Iul Com

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

Standard financial investment accounts usually supply greater returns and even more adaptability than whole life insurance coverage, however entire life can provide a reasonably low-risk supplement to these retired life cost savings techniques, as long as you're certain you can manage the premiums for the lifetime of the plan or in this instance, up until retirement.

Latest Posts

Mutual Of Omaha Guaranteed Universal Life

Max Funded Insurance Contract

Guaranteed Universal Life Insurance Quotes