All Categories

Featured

Table of Contents

There is no one-size-fits-all when it revives insurance. Getting your life insurance policy strategy best takes right into account a variety of factors. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your busy life, economic independence can appear like a difficult goal. And retired life might not be leading of mind, due to the fact that it seems thus far away.

Fewer companies are offering typical pension plan strategies and lots of business have lowered or ceased their retired life strategies and your capability to count solely on social safety is in inquiry. Even if advantages haven't been minimized by the time you retire, social security alone was never meant to be sufficient to pay for the lifestyle you desire and are worthy of.

/ wp-end-tag > As part of a sound monetary method, an indexed global life insurance plan can aid

you take on whatever the future brings. Before dedicating to indexed global life insurance coverage, right here are some pros and cons to take into consideration. If you select a good indexed global life insurance coverage plan, you might see your cash value grow in value.

No Lapse Universal Life Insurance

Given that indexed global life insurance policy calls for a particular degree of risk, insurance firms often tend to maintain 6. This kind of plan additionally offers.

If the selected index does not execute well, your money value's growth will be influenced. Usually, the insurance provider has a vested interest in executing better than the index11. There is typically an assured minimum rate of interest rate, so your strategy's growth won't drop below a specific percentage12. These are all elements to be thought about when picking the most effective kind of life insurance policy for you.

Single Premium Universal Life Insurance Pros Cons

Given that this type of plan is much more complex and has a financial investment component, it can commonly come with higher premiums than other plans like whole life or term life insurance. If you don't believe indexed global life insurance coverage is right for you, below are some options to take into consideration: Term life insurance policy is a short-term plan that typically uses insurance coverage for 10 to three decades.

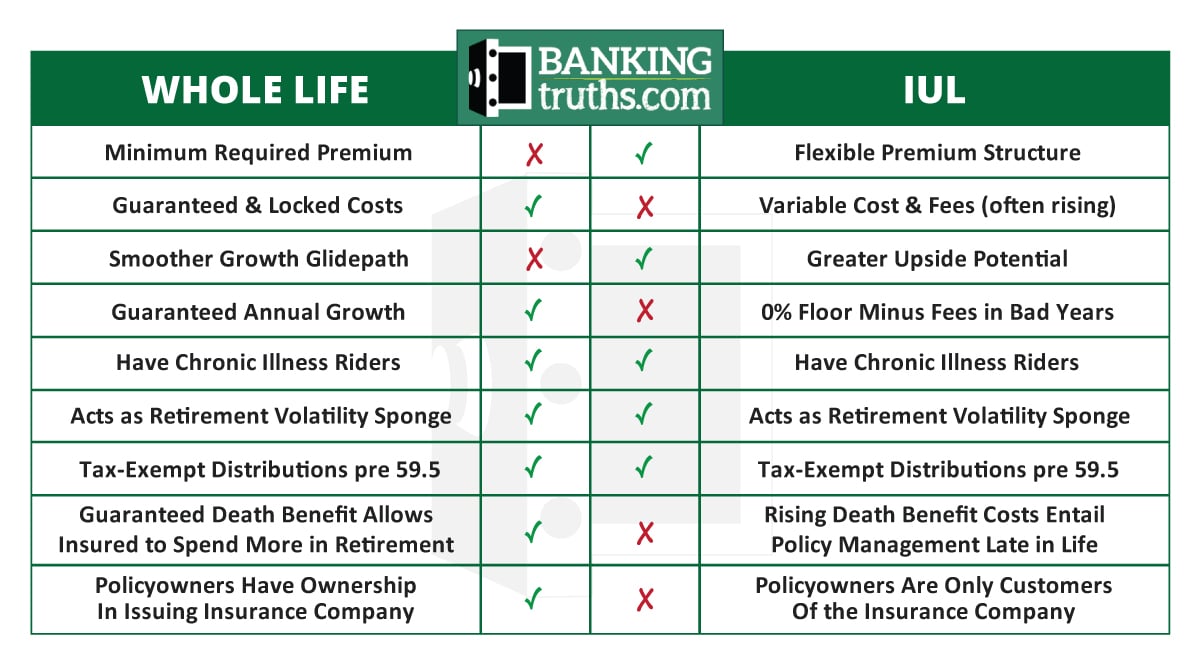

When deciding whether indexed universal life insurance coverage is best for you, it is very important to think about all your options. Entire life insurance might be a much better option if you are searching for even more stability and consistency. On the other hand, term life insurance policy may be a far better fit if you only need protection for a specific time period. Indexed global life insurance policy is a kind of plan that offers more control and flexibility, in addition to greater cash worth growth capacity. While we do not offer indexed global life insurance, we can offer you with even more information about entire and term life insurance coverage plans. We advise discovering all your choices and talking with an Aflac representative to discover the very best suitable for you and your household.

The rest is added to the cash money worth of the policy after costs are deducted. While IUL insurance may verify useful to some, it's essential to understand just how it functions before purchasing a policy.

Latest Posts

Mutual Of Omaha Guaranteed Universal Life

Max Funded Insurance Contract

Guaranteed Universal Life Insurance Quotes